- | F. A. Hayek Program F. A. Hayek Program

- | Government Spending Government Spending

- | Policy Briefs Policy Briefs

- |

Tax and Expenditure Limits for Long-Run Fiscal Stability

In the public sector, no tool adjusts spending to changing conditions. In the current recession, many states have decreased revenues, but little decreased spending has been seen. This pattern raises a difficult question.

In the private sector, the profit and loss mechanism signals firms to adjust their production and costs quickly to changes in demand and revenue. In the public sector, no tool adjusts spending to changing conditions. Instead, policy makers have incentives to increase government spending year after year, regardless of tax collection: Vested interests can benefit greatly from marginal expenditure increases that build over time, and the political process rewards legislators who cater to their strongest supporters by funneling spending to their programs.

In the current recession, many states have decreased revenues. Because government services have grown unchecked, these states now must make painful and unpopular cuts. California, Arizona, and New Jersey, among other states, have made headlines in recent months with their drastic measures to close budget shortfalls.

This pattern raises a difficult question: How do states correct for the inflexibility inherent in state expenditure systems to respect taxpayers' desires for government services over time? Some states have experienced relative success in this area because of Tax and Expenditure Limits (TELs) that constrain their budgets. While not a perfect solution, binding TELs prevent policy makers from increasing state spending that does not reflect voters' willingness to pay for government services.

TAX AND EXPENDITURE LIMITS

Effective TELs rely on direct democracy to ensure that spending increases reflect the will of the majority. These TELs require that voters approve the spending of excess revenue or tax increases through ballot initiatives. This process forces policy makers to propose spending increases to voters clearly and concisely, preventing incremental spending increases that benefit only a select group of people.

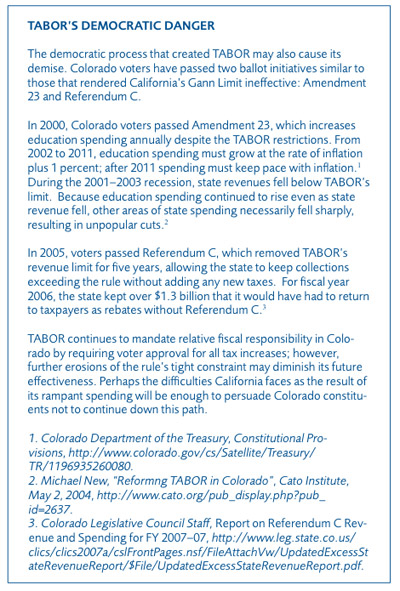

Currently, the strictest TEL in the United States is Colorado's Taxpayer's Bill of Rights (TABOR).1 Added to Colorado's state constitution by a 1992 ballot initiative that passed with close to 53 percent of the vote, TABOR stipulates that if per capita state revenue grows faster than inflation, the state must either return the excess revenue as a tax rebate or carry out a ballot initiative to ask for voter approval to keep it. Though Colorado has had budget shortfalls during the current recession, TABOR's strong restrictions on state spending have prevented a crisis like those unfolding in other states.

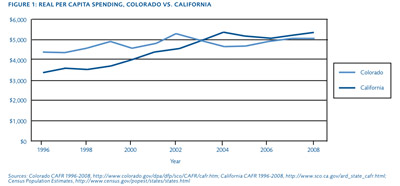

TELs that legislators can work around do not restrain spending. California's 1979 Gann Limit, for example, has failed to prevent the state budget from growing out of control. Although this rule originally restricted the growth of state expenditures to the 1978-1979 level adjusted for population growth and inflation, amendments adopted in the late 1980s and the early 1990s allow for increased education spending. The increased education spending mandate at first decreased funding available to other state programs, leading to support and eventually voter approval of increases to transportation spending as well. Although the Gann Limit continues to provide spending limits in theory, in practice, thanks to a multitude of amendments, the state's budget has grown unchecked for nearly 30 years.2 Figure 1 shows how California's per capita spending surpassed Colorado's, even though states with smaller populations usually pay higher per capita taxes because they lack economies of scale.

The 2001-2003 economic contraction illustrated the power of an effective TEL and foreshadowed the difficulties that states currently face. In 2005, Colorado's budget shortfall reached 1.5 percent of its annual budget, compared to California's 127.5 percent deficit.3 For fiscal year 2010, the GoldenState faced a $42 billion shortfall, and the outlook for next year is even worse.4

Strict limitations on state spending have clear economic advantages. Moreover, policy makers should remember that TELs like TABOR are not absolute limits on state expenditures; in fact, real per capita expenditure in Colorado has increased by over 28 percent since TABOR took effect.5 During the same period, the state's per capita GDP increased about 30 percent, outpacing the growth rate of state spending. TABOR does not prevent improvements in state services, but it does ensure that the taxpayers approve increased spending.

LEARNING FROM TABOR

States that are considering implementing TELs should use TABOR as a starting point for legislation, but they also must recognize TABOR's weaknesses. Particularly, states should not emulate TABOR when determining revenue caps and the scope of their TELs in the federalist system. However, those wishing to adopt TELs should pay close attention to the process that produced Colorado's effective limit: constitutional change. TABOR has been effective over the years in part because it was passed as an amendment rather than adopted through the legislative process. If states desire effective TELs, they should realize that constitutional taxing and spending caps tie policy makers' hands much more effectively than rules that these policy makers adopt themselves and are free to change.

Previous-Year Revenue Caps

While TABOR is an effective constraint on the growth of state government, it caps revenue at the previous year's level rather than some voter-determined level of state spending. If per capita revenue is low one year because of a downturn in economic activity, the next year the cap will be set at that lower level regardless of trends in state residents' per capita income. As a result, the state would have trouble recovering its original level of funding after a recession. A TEL that incorporates a limit that represents an average of past years' revenue levels could lower the budget's sensitivity to variations in economic activity. Also, voters are more likely to support a TEL with a revenue limit based on an average of a few past periods over one with a previous-year revenue cap.

However, while average spending caps help smooth spending across the business cycle, they also make TELs more rigid in adjusting their spending to changes in revenue. Policy makers and constituents should consider the advantages and disadvantages to yearly caps and average caps when crafting their own TELs.

Municipal TELs

TABOR limits municipal revenues according to the same formula binding the state revenue. These state caps on local budgets restrict the home rule for which Colorado is known.6 If some constituents wish to live in a locality with a high level of taxation and public services, they should be free to live in a place that does not require ballot initiatives for all tax increases. States that seek to preserve local autonomy should limit the scope of their TELs to state budgets.

Some economists, however, see a danger in allowing municipalities to determine their tax rates. They posit that too much municipal autonomy leads to increased local government because the complexity of government budgeting masks voters from the true costs of programs; therefore, they suggest that the statewide implementation of municipal TELs is the most prudent budget limit.7 Furthermore, if a municipality is fiscally irresponsible and runs the risk of severe budget consequences such as defaulting on its bonds, it may seek a bailout from the state. As soon as one municipality received a bailout, the incentive for fiscal responsibility at the local level would be greatly reduced. For a state TEL to function properly in combination with home rule, states must refuse to bail out municipalities if they are fiscally irresponsible. Despite these caveats to the benefits of municipal budget autonomy, the importance of home rule—combined with freedom of movement between municipalities—outweighs the risk of the growth of municipal revenues without a state-enforced TEL.

Constitutional TELs

Politicians who seek office on a platform of fiscal responsibility may suggest adopting a TEL through the legislative process, but a rule that could easily be overturned is not nearly as effective at limiting the growth of government services to those desired by taxpayers. The adoption of TELs at the constitutional level is critical to their successes.

As part of such a constitutional adoption, requiring a supermajority vote to change constitutional amendments could enhance policy stability and make it more difficult for special interests to alter the content of a TEL.8 For example, such a requirement could have prevented Colorado's Amendment 23 that caters to the state's education interests at the expense of others. However, while a supermajority has advantages in strengthening tax and revenue limits, it also makes them more difficult to adopt. TABOR, for example, was adopted with a narrow vote and would not have passed with a supermajority requirement. Each state must decide what approach would work best in its political environment.

CONCLUSION

A well-designed TEL removes the opportunity for state policy makers to increase services and the taxes required to support them. Initiatives structured like TABOR do not restrain government spending completely; they only ensure that all spending increases reflect the majority of taxpayers' desires for government services. Well-designed TELs enhance the stability of the policy environment, assure state residents that taxes will not rapidly increase unless a majority is in favor of change, and curb budget growth enough to forestall major crises.

TABOR demonstrates the TEL's potential to restrain government growth and spending through the constitutional process. Because Colorado has had a tight budget constraint for years, other states can observe its long-run success and build upon this model to create rules that constrain public spending. Effective TELs such as TABOR better reflect voters' desire for growth in government spending than other politically possible rules. Rather than originating as legislation that can easily be overturned with changing political climates, limits should come as constitutional change supported by the majority.

ENDNOTES

1. Therese J. McGuire and Kim S. Rueben, "The Colorado Revenue Limit: The Economic Effects of TABOR," (briefing paper no. 172, Economic Policy Institute, March 21, 2006).

2. Michael New, "The Gann Limit Turns 25," The Cato Institute, http://www.cato.org/pub_display.php?pub_id=2871

3. Robert Bigot, "California TABOR Dreamin'," opinion editorial, Independence Institute, May 11, 2005, http://www.i2i.org/main/article.php?article_id=1260.

4. Shikha Dalmia, Adrian Moore, and Adam B. Summers, "Don't Blame Voters for California's Budget Woes," The Wall Street Journal, October 3, 2009, http://online.wsj.com/article/SB100014240529702045185045744173504289441….

5. State of Colorado Comprehensive Annual Financial Reports, 1993-2007.

6. State constitutions vary in the degree of autonomy that they provide their municipalities. Colorado's constitution declares: "The people of each city and town of this state . . . are hereby vested with, and they shall always have, power to make, amend, add to or replace the charter of said city or town, which shall be its organic law and extend to all its local and municipal matter" (Colorado Constitution, Article XX, Section 6, http://www.colorado.gov/dpa/doit/archives/constitution/1876.pdf). As Michael E. Libonati writes in the book State Constitutions for the Twenty-first Century, Colorado's constitution "immunize[s] the home rule unit from state legislative interference in all local and municipal matters" ("Local Government," State Constitutions for the Twenty-first Century, Alan Tarr and Robert F. Williams, eds. (New York: State University of New York): 2006. In the case of Colorado, power granted to municipalities in the state constitution renders the state's cap on municipal revenues inappropriate.

7. For a discussion of home rule's role in fiscal illusion, see Gyusuck Geon and Geoffrey K. Turnbull., "The Effect of Home Rule on Local Government Behavior: Is there no Rule Like Home Rule?" (working paper no. 04-05, Urban and Regional Analysis Group, September 2004), http://aysps.gsu.edu/urag/workingpapers/2004/urag_0405.pdf.

8. For a discussion on this topic, see Robert Kroll, "The Role of Fiscal and Political Institutions in Limiting the Size of State Government," Cato Journal 27, no. 3 (Fall 2007), 431-445.

To speak with a scholar or learn more on this topic, visit our contact page.